Home » How to Measure Customer Experience (CX) in 2020

How to Measure Customer Experience (CX) in 2020

Jay Nathan

Founder & Managing Partner, Custom Imperative

According to a B2B Marketing survey, two-thirds of marketers plan to make customer experience (CX) a priority over the next year. More than a quarter of those surveyed are prioritizing CX before the year-end to get ahead.

The companies that are fine-tuning their customer-centric CX programs experienced strong revenue growth and ROI, reporting more than 2X return on their investment.

We understand that improving and measuring customer experience is good for customers and for business KPI’s. A focus on CX drives customer retention, revenue expansion, and enterprise valuation over time.

In this article, we’ll outline what exactly is necessary to prioritize and measure customer experience in 2020.

CX Data Sources

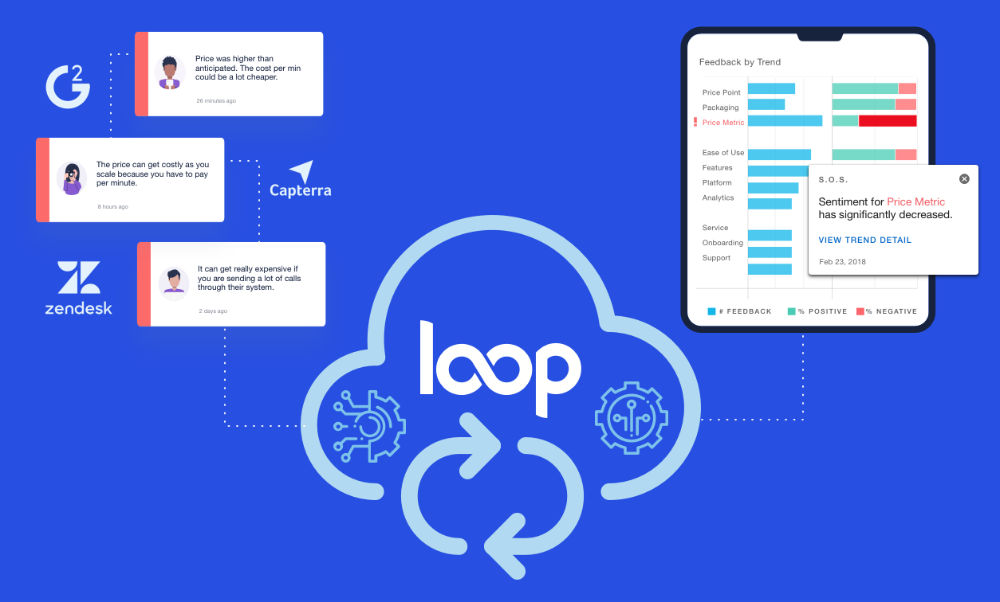

B2B SaaS companies have multiple sources of CX data—learning management systems, support cases, CRM, customer success platforms, marketing automation tools, content management systems, and online communities.

We can use these to infer the customer experience by proxy, so we don’t have to rely solely on surveying [eople for measuring customer experience performance.

For example, using information from our case management system (Zendesk, Service Cloud, etc) we can easily measure whether or not we are meeting customer service level agreements (SLAs). Knowing whether we are meeting our service delivery standards is one point of many that we can use to understand our CX performance.

Other customer experience indicators include:

- Critical bugs or outages experienced by customers

- Customer onboarding and time to value

- Key feature utilization rates

- Open support cases greater than N days old

- Closed-loop follow up percentage (after negative feedback)

We can track internal processes related to onboarding, support, product and customer success that addresses all of these areas.

NPS vs CSAT

While access to internal data is an advantage, it doesn’t tell the complete story. We need to capture feedback directly from customers.

There are two primary tools we can use to collect customer sentiment throughout their journey: Net Promoter Score (NPS) and Customer Satisfaction (CSAT) surveys.

Net Promoter and Customer Satisfaction are two very different, but complementary methods of gathering customer insights on their experience.

NPS measures a customer’s overall satisfaction with and loyalty to the company. NPS is a simple feedback mechanism that asks, “How likely are you to recommend [company] to a friend or colleague?”

NPS respondents provide a 0-10 rating with zero being the least likely and 10 being the most likely to recommend. Detractors (0-6s) are subtracted from the total number of promoters (9s and 10s) to give a net promoter score.

Because of its simplicity, NPS receives a higher response rate from survey recipients. In addition to having a score we can use to track and measure brand loyalty, NPS also provides verbatim feedback to give context to the customer experience and feedback behind the score.

CSAT measures customer sentiment related to a specific type of interaction at the point of delivery. These surveys are normally sent after a training session, onboarding, or closure of a support case.

CSAT is based on a five-point rating system ranging from “Very Dissatisfied (1)” to “Very Satisfied (5).” The percentage of respondents providing a “Satisfied (4)” or “Very satisfied (5)” response make up the CSAT score for that interaction.

How to measure CX

Now let’s dive into more detail on which customer experience measures are most effective for illustrating CX and its impact on your business.

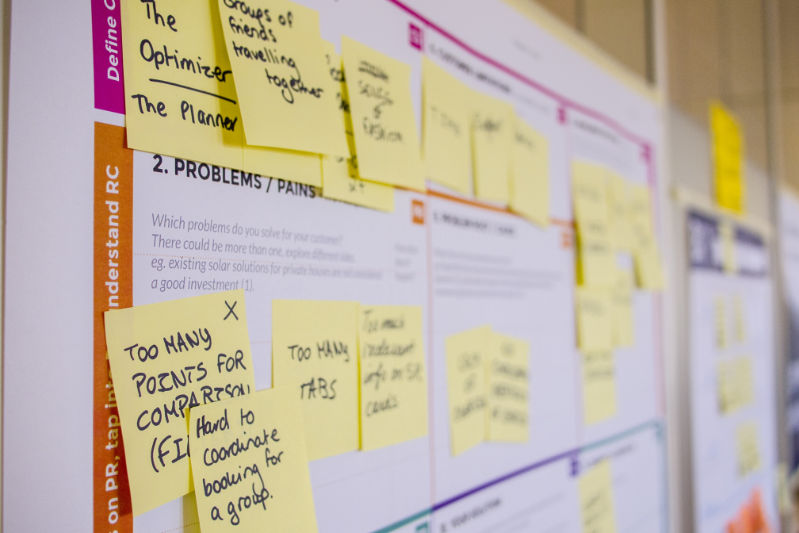

The 2×2 matrix below outlines four types of CX metrics. The types are based on whether they are leading or lagging indicators and whether they measure strategic or transactional customer interactions.

Strategic and Transactional Interactions

- Lagging metrics represent outcomes and tell us what the customer experience was in the past.

- Leading metrics help us predict future outcomes and experiences.

It’s important to have leading metrics associated with each lagging metric that we care about. Attempting to manage on lagging metrics alone – such as net promoter score (NPS) – is akin to trying to lose weight without paying attention to calorie intake or exercise.

Interactions are the touchpoints we have with customers. Strategic interactions help us move customer relationships forward and grow them while transactional interactions are operational in nature, (e.g. onboarding, training, handling support cases, daily product usage).

Defining each type of B2B CX measurement

Below are an array of metrics that offer a balanced perspective on the customer experience. Every SaaS business is unique, but companies should be looking at a mix of these metrics across their brand’s customer journey.

Customer Loyalty, Health, and Outcome Metrics

This category contains metrics that indicate the strategic value and risk of the customer base and contains sentiment, health and loyalty metrics. Customer loyalty, referenceability, NPS, retention, and up-sell rates fall into this category.

Customer Engagement Metrics

Customer engagement metrics measure strategic interactions with our customers that lead to retention, growth, and loyalty. Examples include reviews of services, social media comments, reference requests, up-sell opportunity identification and customer community engagement interactions.

Delivery Quality Metrics

As a B2B SaaS company, there are some activities we must do well but don’t provide much upside lift in customer experience metrics. I think of these as “price of entry” processes, and they include product availability/uptime, service delivery, and customer support responsiveness. People expect these day-to-day interactions to be reliable and dependable.

Transactional Results Metrics

Transactional results help us understand tactical outcomes related to tactical customer delivery interactions.

CX Leading and Lagging Indicators

Here are a few rules of thumb to follow when establishing your customer experience measurement practice and choosing metrics for your dashboard:

- Start small. Start with 8-12 metrics that hit on the key interactions and customer outcomes you’re looking for. Prioritize delivery quality and customer engagement metrics and validate their correlation to customer and business outcomes.

- Set baselines and establish targets. Especially if embarking on CX measurement for the first time, it’s important to understand a baseline value for each metric. Once established you can determine the appropriate target for each metric.

- Plan initiatives based on deviation from targets. Remember what we are doing all this work for: to drive new improvement in the customer experience and business outcomes for our customers and our own organization. Customer experience management in B2B SaaS is a continual process. A formal measurement process will make initiative planning become a data-driven process.

- Segment customers. Many SaaS providers serve a wide variety of customers ranging from small corporations to large enterprises. CX issues can easily be hidden in the data. If possible, break down metrics by having a dashboard at the customer segment to develop a deeper understanding. Most often this will align with go to market segments.

- Track over time. We see far too many dashboards that represent one static point in time. Unless we plot these new metrics over time and examine trends it’s difficult to understand whether we’re on a positive or negative path in a given area. It’s also impossible to spot the correlation between metrics.

- Use a mix of internal and external sources to cross-compare what our internal process data indicates versus what customers are actually feeling.

- Get executive buy-in. CX is not something that anyone department alone can control. A recent Accenture survey revealed that although 90% of B2B executives reported that CX was crucial to their company, only 72% of them had actual influence over CX initiatives.

Craft a customer experience strategy statement defining how you intend to use CX as a competitive advantage and incorporate it into your annual goals and planning. CX takes cross-functional collaboration, so ensure your strategy reflects the needs and goals of every department, from Customer Success to Sales, Product, and Engineering.

Despite the importance of customer experience to the health of every B2B SaaS company, virtually all SaaS companies are still building CX disciplines. Creating a focus on CX within your organization now can create a competitive advantage in the marketplace that will be difficult to mimic.

A different version of this article originally appeared on Customer Imperative’s blog.